Rethinking claims processing

Due to the large number of frequent claims with a wide range of damage symptoms and affected properties, as well as contracts with individually negotiated conditions, the range of tasks to be performed by insurance employees has become a touchstone. One aspect that is particularly complex in everyday practice is communication with real estate companies and external parties via a range of channels, including fax, email and phone. This may involve transmitting appraisals, reports and photos of the damage, checking and releasing invoices, or creating credit memos. How can everything be kept under control here? Each medium has its advantages and disadvantages. Up to now, there has been no stringent solution that covers all task areas relating to an insurance claim and digitally connects all parties involved. Although an ERP system allows users to manage all contract and property data as well as archive documents, it lacks the essential means for communicating and connecting with third parties. A communication platform provided by PROMOS is a tried-and-tested miracle weapon in the fight against floods of paper and mazes of interfaces.

The pivotal role of the easysquare insurance portal

The PROMOS insurance portal, which was developed in collaboration with AVW Versicherungsmakler GmbH within the easysquare platform, allows you to store existing contracts with different real estate companies complete with all contract conditions as well as the master data of the insured real estate objects. This forms the basis for subsequently checking insurance claims and settling claims. The aim of the portal solution is to reduce the necessary communication and data exchange between the various parties to a minimum, thus achieving a degree of automation that allows a fast, contract-compliant solution. Claims can be settled in two ways. Either the insurance company pays the order amount directly to the trade company providing the service, or a payment is made to the real estate company.

Decision from case to case – automated or manual

When the insurance company receives an insurance notification via the portal, the system automatically checks whether the contractual requirements for payment are met. Does a valid contractual relationship exist for the damage period? Are the damage symptom and the property concerned covered? Has the maximum claim amount already been exceeded? It is also possible to establish a maximum deductible in the portal, the existence of which is automatically checked by the system. When a new claim is received, the administrator can thus proceed directly to the decision phase, without having to plough through the relevant contracts first. It is also possible to set up an automatic test cube release function that allows background processing for a large number of frequent claims. This means, for example, that a fixed percentage of insurance claims up to a certain extent of damage are automatically released and thus settled if the contract conditions are met. Manual processing is then no longer necessary. The processing status of the insurance notification is indicated by a status such as “insurance claim closed”, “requires manual inspection”, “property not insured” or “test cube release”. On the portal, the insurance claim concerned forms the basis for all further data and information. All invoices, photos, appraisals or other documents involved can be assigned to it. Invoices for orders relating to the rectification of the damage can be released, in a similar way to the insurance claim itself, and have a separate status, such as “paid”, “within deductible”, “claim limit exceeded”, “partial payment”. Again, an automatic decision can be made by test cube.

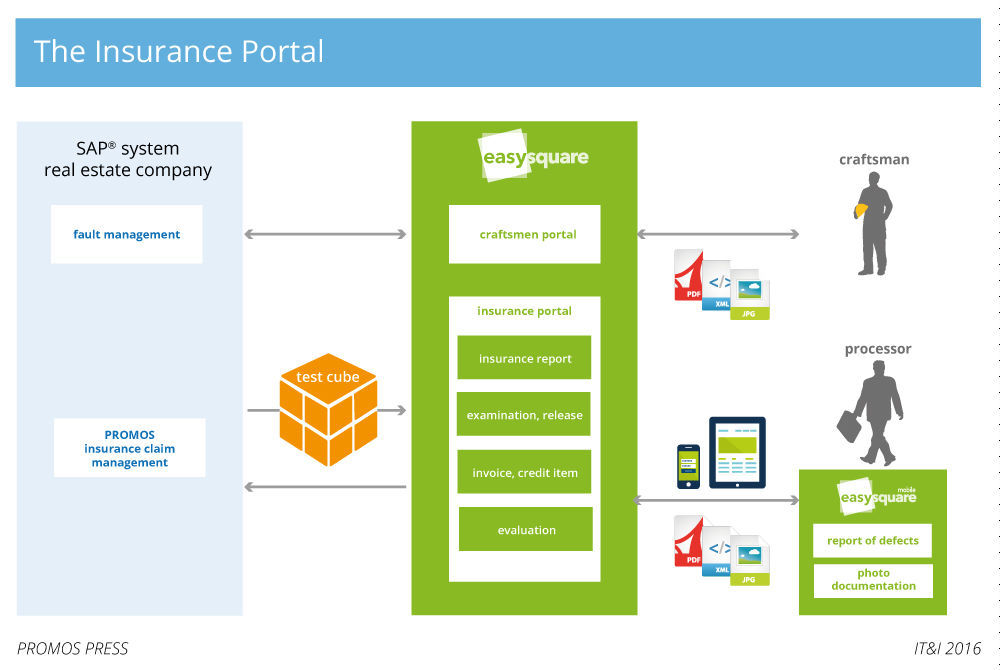

Figure 1: The insurance portal as part of a 360 degree overall solution. |

Smartphone instead of briefcase

As a rule, minor claims settlements are released by the insurance company without any individual verification. In the case of larger damage amounts or other conspicuous features, however, it is a good idea to look into the matter on site in person. Using a mobile solution that provides access to all information regarding the insurance claim has proven to be practical here. The easysquare mobile app displays all relevant data regarding the defect notifications that are currently open. The processor at the insurance company can synchronise this data and, in parallel, record additional information about the damage or photos for the case in the app. Once saved, the data is automatically available on the easysquare platform via the web portal. This allows consistent digital processing without the loss of information.

Is it worthwhile?

Insurance companies use past and existing

contracts as a basis for defining new contracts. Various evaluations can be

performed on the insurance portal. One option of interest, for example, entails

outputting the actual costs in a particular year in relation to the insurance

premium paid, grouped based on damage group and risk class. In this way, the

extent of the deductibles as well as the maximum claim amount can be determined

separately. On top of this, it is possible to constantly monitor open and paid

invoice amounts as well as perform a budget check for selected risks and damage

symptoms.

Side by side with real estate companies and tradesmen

The insurance portal guarantees a 360 degree connection to the policy holder as well as the commissioned trade companies. In this way, the insurance portal can be automatically connected to the real estate company’s SAP® system, in which PROMOS insurance claim management ensures that incoming claims are processed in a standardised manner. If claims are settled directly between the insurance company and trade company, the real estate company receives all the necessary information regarding the payment made, for instance for the purpose of internal cost allocation. Coordination with the tradesman – be it on the part of the insurance company or the real estate company – is facilitated by connecting the easysquare tradesmen portal. This allows completely integrated and digital order processing from commissioning through to settlement and can be linked to the insurance portal and/or the real estate company’s ERP system.

Summary

ast and efficient processing of claims is in the interest of all parties involved. If the defined requirement is met, the insurance portal not only makes an automatic decision regarding the insurance claim, but also provides evaluations in the form of important KPIs as well as a high level of transparency with regard to the decisions made. In this way, claims can be processed quickly, without much expense.

Author:

Eric Hoedke

Expert Consultant

PROMOS consult

Other articles by this author:

- Article "Well-informed – the new mobile report history for the easysquare professional app"

- Article "Fine tuning in purchasing – VW Immobilien is optimising the planning of their supplier orders with value contracts in SAP®"

- Article "KoWo is settling up! Automated posting of apportionable services in the craftsmen portal"

- Article "The new craftsmen portal – a modern look, high-speed performance and practical functions"

- Article "Rethinking claims processing"