Radically simplifying consolidation

A traditional record-to-report process encompasses all activities involved in creating a financial report at the end of a respective period. From local bookkeeping and preparing and uploading data all the way to the classic consolidation processes, numerous individual steps must be ticked off before the report can actually be created and analysed. Information from the bank accounts, main ledgers and sub-ledgers must first be processed, then analysed and potentially readjusted, meaning that these processes can easily end up taking several days. If a company assembles an annual report only once a year, then this effort may be of little consequence, making the report a relatively low-pressure undertaking. As soon as companies begin creating financial statements on a quarterly or even monthly basis, however, employees must regularly deal with higher work and stress levels leading up to the respective reporting date.

The consolidation dilemma

The consolidation clerk must deal with various stumbling blocks leading up to the period end. The first comes during the data upload. If the responsible departments have not prepared their data in time, the clerk will already be behind schedule at the beginning of the process and have to bridge long waiting times. In practise, it is not uncommon for the clerk to finally receive the data only to suddenly determine that the intercompany amounts do not match up or that the master data from the ERP was not harmonised. If the data cannot be validated before the delivery deadline, stress is a foregone conclusion. In such a scenario, the clerk must then decide whether to undertake the necessary adjustments in their own consolidation tool or request the data from their colleagues once more. Anyone facing this decision is truly between a rock and a hard place. If the clerk decides to make a top-line adjustment, there remains the risk that the original mistake will not be corrected by the end of the next period and that yet another top-line adjustment will have to be made. However, requesting the data again leads to further delays in the process and may prevent deadlines from being met (Figure 1).

Figure 1: Experience with the reality of consolidation delivers reasons for the new efficient real-time consolidation in S/4HANA®.

Figure 1: Experience with the reality of consolidation delivers reasons for the new efficient real-time consolidation in S/4HANA®. |

Today, financial planning and forecasting are no longer simply needed on set reporting dates – companies require continuous insight into their financial situation. Against this background, fast close and real-time consolidation in S/4HANA® represent a welcome liberation from the consolidation madness of the past.

Finally, reports with real-time data

Now what characteristics would a consolidation specialist want in their tool? Shared master data in a fully integrated end-to-end solution, simple traceability, simulation possibilities and less need for coordination? We would surely find all of these demands on the wish list of every corporate accountant.

Sometimes the solution is much closer than you would think. With S/4HANA® and the in-memory capacities, SAP creates the ideal prerequisites for real-time consolidation. Thanks to the dense integration of SAP S/4HANA®, SAP Business Warehouse (BW) and SAP Business Planning and Consolidation (BPC), users can access master and transaction data via their ERP system in real time. Data replication is reduced to a minimum. A single information source ensures that master data, settings and rules remain the same. In this way, actual and planning data are consolidated using the same rules.

In addition, real-time consolidation with SAP® RTC offers the full functionality of standard consolidation, from uploading and validating additionally required external data to IC coordination and elimination and on to manual journals. Certain features are particularly important for creating simplicity. For example, currency conversion is performed in the ERP system using the familiar exchange rate tables. Validations are already possible in the individual financial statements, and the timeliness of the data remains traceable thanks to a time stamp. Two consolidation categories enable simulation as a preliminary or as a final consolidation. Postings in RTC are real postings with a document type and document number. Write-back in S/4HANA® takes place in the ACDOCC table. Drillthrough to the level of individual items and the solution’s incorporation of customer-specific fields round out the list of new features and represent a response to user feedback.

Thanks to the close interaction between the consolidation process and the ERP core, real-time consolidation can fulfil its three promises. Data exchange between the systems is kept as low as possible (1), the time required for financial statements is reduced (2) and simulation possibilities are integrated (3). The solution is operated through modern, user-friendly interfaces that satisfy the demands for an app used across multiple devices and tailored to the specific role of the user.

High speed to period end

Troubleshooting and coordination and correction cycles needlessly take up time while making corporate financial reports more challenging. To enable acceleration in the sense of fast close, the data to be consolidated must be made available both more quickly and in higher quality.

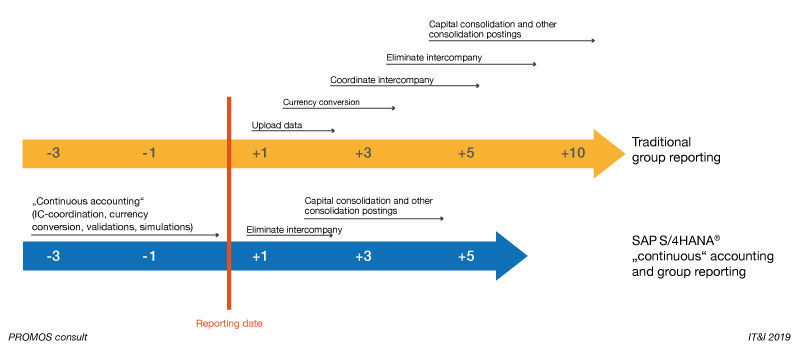

A look at the reporting process says it all. If traditional reporting is compared with that using real-time consolidation, the potential for optimisation is clear (Figure 2). Since RTC is directly based on S/4HANA® and thus allows real-time data transfer across the technical infrastructure, certain components of the consolidation process can be simulated or performed prior to the reporting date according to the principle of “continuous accounting”. This significantly reduces post-processing effort following the reporting date.

Figure 2: Deploying real-time consolidation significantly helps accelerate preparations for reports (fast close) and has been proven to shorten the reporting process.

Figure 2: Deploying real-time consolidation significantly helps accelerate preparations for reports (fast close) and has been proven to shorten the reporting process. |

Distributing the reporting work uniformly across the business year has the additional advantage of using report creation as a continuous, partially standardised process instead of a major yearly event. The standardisation, automation and optimisation of quality and costs represent important tuning mechanisms for fast close and, more generally, for digitalisation in accounting.

A boost from universal journal

Reduced reporting time, real-time data access – how is that possible? This calls for a short lesson in data logic. Financial management in S/4HANA® is based on a data model that brings together external and internal accounting information, thus creating a single source of truth. From a technical standpoint, this simply means that all postings from financial accounting (FI-GL), asset accounting (FI-AA), the material ledger and the actual postings from controlling (FI-CO) are collected in one table, which eliminates their redundant storage in different tables. This gem carries the designation ACDOCA and is more commonly known by the name universal journal. If duplicate data storage can be avoided, this also eliminates the need for synchronisation of the data, which must only be accessed once. All of this saves storage space in the archive and increases data throughput, i.e. the amount of data that is transported through the system.

Upward trend for downward practise

Whether record-to-report, fast close or universal journal – despite an inherent deep dive into the specialist terminology of consolidation, their strategic relevance for corporations and, increasingly, for medium-sized companies cannot be stressed enough. Over the long term, developments will move away from conventional consolidation using the time-consuming bottom-up approach by which individual branches of a company prepare reports for the next corporate level. Instead, the future will increasingly see companies using integrated software solutions which allow relevant information to be accessed across organisational areas and corporate levels in a top-down approach. With continuous controlling information, companies can profit from gaining early insight, taking timely countermeasures and increasing their long-term competitiveness. S/4HANA® puts the technological prerequisites for this trend into place, and an upgrade to SAP S/4HANA® can help meet every company’s consolidation needs.

Author:

Monika Kasprzak

Consultant Financials

PROMOS consult

Other articles by this author: