Management of Derivatives and Securities

Holistic Management of Derivatives and Securities with SAP®

There are various reasons to be active on the capital market. From simple liquidity investment and the generation of interest payments, the hedging of actual transactions or hedging against negative interest developments to pure speculation, the motivations are as varied as the range of products available on the capital market. In particular on a volatile market – be it the financial market or the real market – hedging against market development is a relevant aspect of risk and company management in almost every company. In this context, what could be more logical than mapping and managing these financial products in the SAP® system?

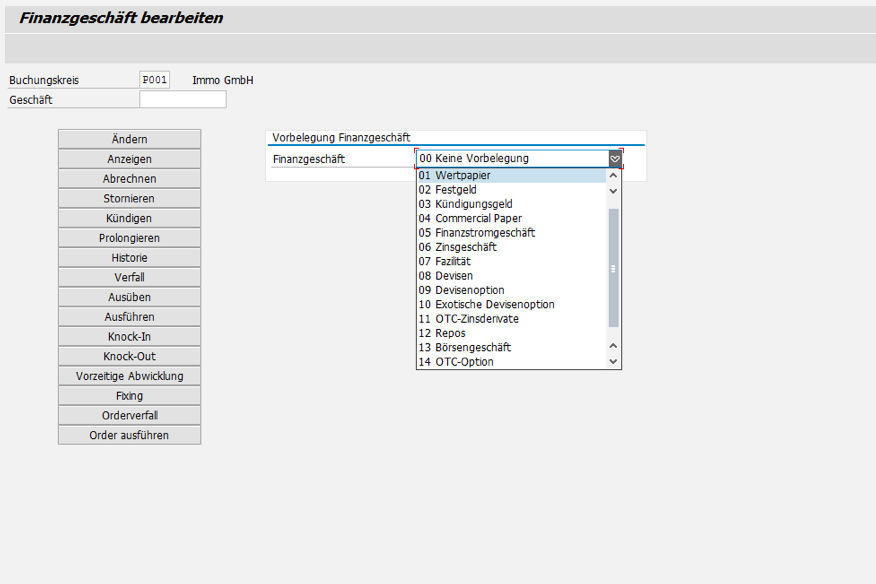

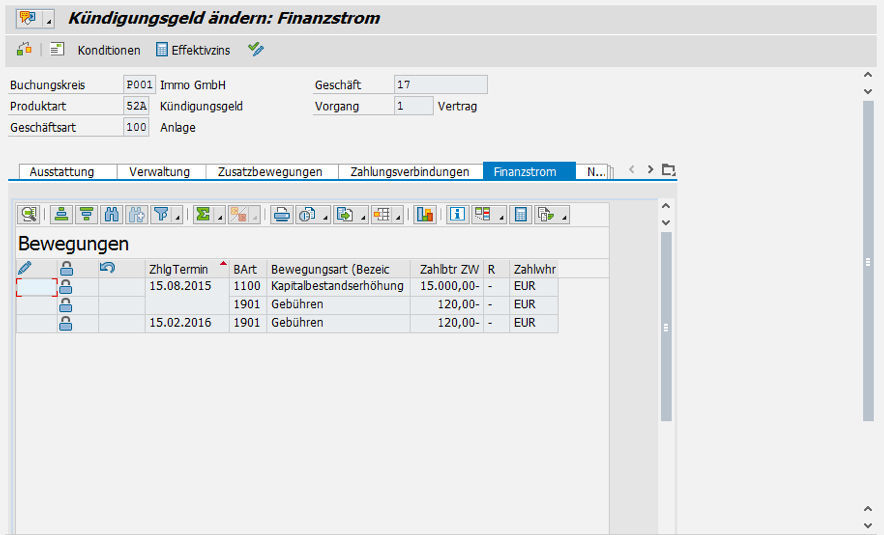

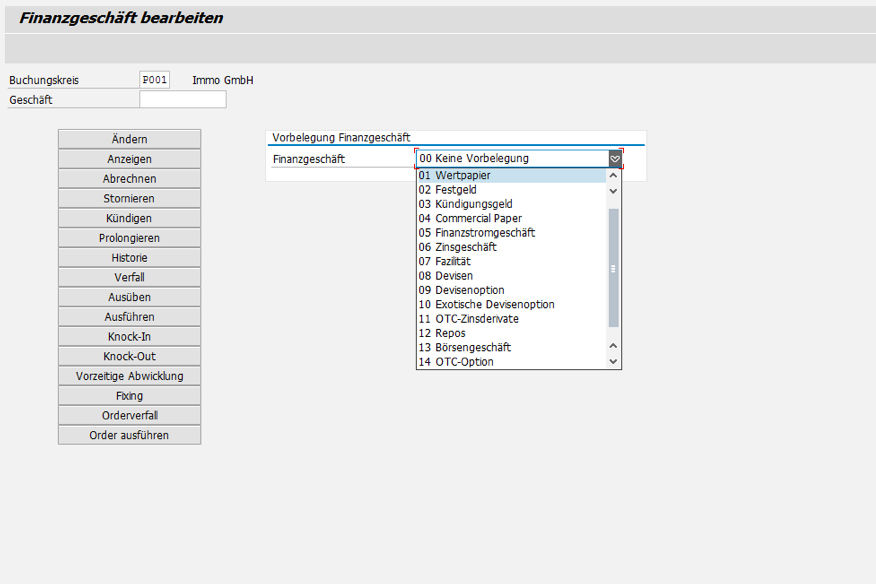

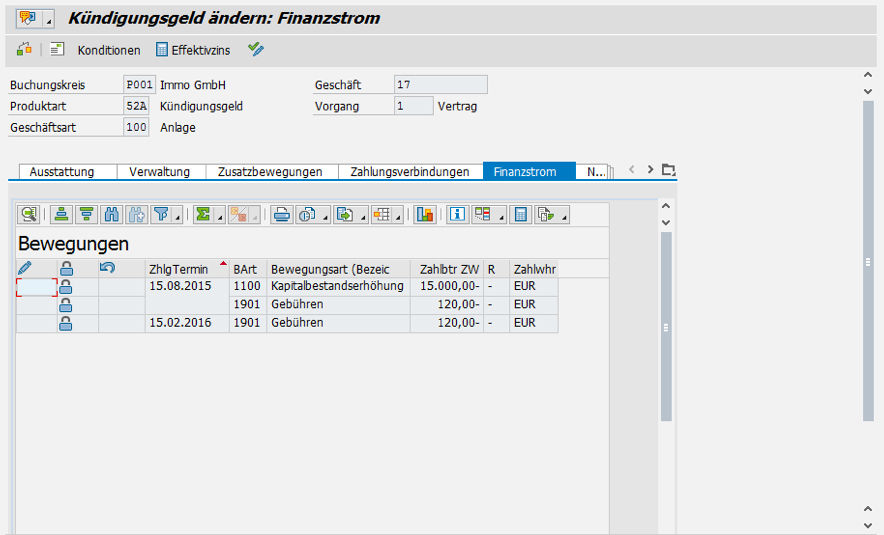

For this, SAP® provides a host of mapping options that can be individually tailored to the individual company’s specific requirements. From conventional money market trading, currency trading and securities management to the sometimes complex products of exchange-traded or purely OTC derivatives, everything from recording and management to posting and evaluation can be carried out directly in the system for every management area, without any complex third-party systems and interfaces.

Further information

- Market Risk Analyzer: The Market Risk Analyzer is an analysis library for identifying potential risks in the existing financial products due to market volatilities. In addition to classical sensitivity and cash value analyses, the Analyzer contains VaR simulations.

- Credit Risk Analyzer: The functions of the Credit Risk Analyzer enable you to cluster market-dependent items by risk based on their cause and control and monitor internal and external limitations.

- Portfolio Analyzer: The Portfolio Analyzer is primarily a KPI and methods library for performance monitoring, control and relative analysis of individual financial operations portfolios.

Your benefit

Consistency: The entire treasury sub-ledger can be mapped and posted in the SAP® ERP system. Posting to the general ledger is available as an option.

Reduction of interfaces: The existing financial products can be analysed and evaluated in the leading application. All third-party interfaces are eliminated.

References

End user

- Finance department

Technical requirements

- SAP®

Please contact us:

PROMOS consult Projektmanagement,

Organisation und Service GmbH

Rungestraße 19

10179 Berlin-Mitte

Germany