Did you know? Virtual accounts for clear allocation of incoming rental payments to lease-outs in SAP®

When transferring rental payments, private and commercial tenants do not always behave as the Accounting department at the real estate company would like.

Payment reasons are not always clear, and payments sometimes contain transposed numbers, typos or incorrect information. In practice, this means additional manual work for the real estate company’s Accounting department.

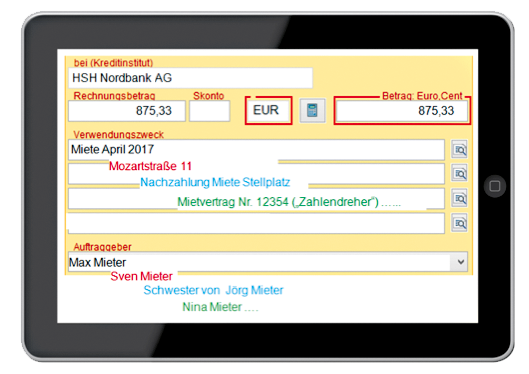

Figure 1: Different payment reasons for incoming rental payments result in a high level of manual follow-up work for housing companies.

How do virtual accounts work?

HSH Nordbank AG, one of the leading real-estate financers in Germany, has recognised this problem and, together with PROMOS, provides its customers with a time-saving solution for clearly allocating rental payments to customer accounts – the HSH PROMOS Cash Connection software.

Each tenant receives a virtual account number or IBAN from the real estate company and transfers the rent to this account. The bank then immediately transfers these incoming payments to the landlord’s actual account. Manual follow-up work is no longer necessary, as the allocation of each individual lease-out to a virtual and thus property-specific account number has already been implemented in the SAP® system with the aid of PROMOS. The electronic bank statement shows the landlord which virtual account the money was sent to. This automatic further processing enables automated posting of payment receipts from rent, leases or housing benefits with a hit rate of almost 100 percent.

The solution works on both the accounts receivable and accounts payable side. This means that, in the case of a business with a branch network, electricity payments to the energy supplier can be allocated to the individual branches via direct debit payments from virtual accounts. The payments can be posted automatically, generating potential savings and avoiding extra work.

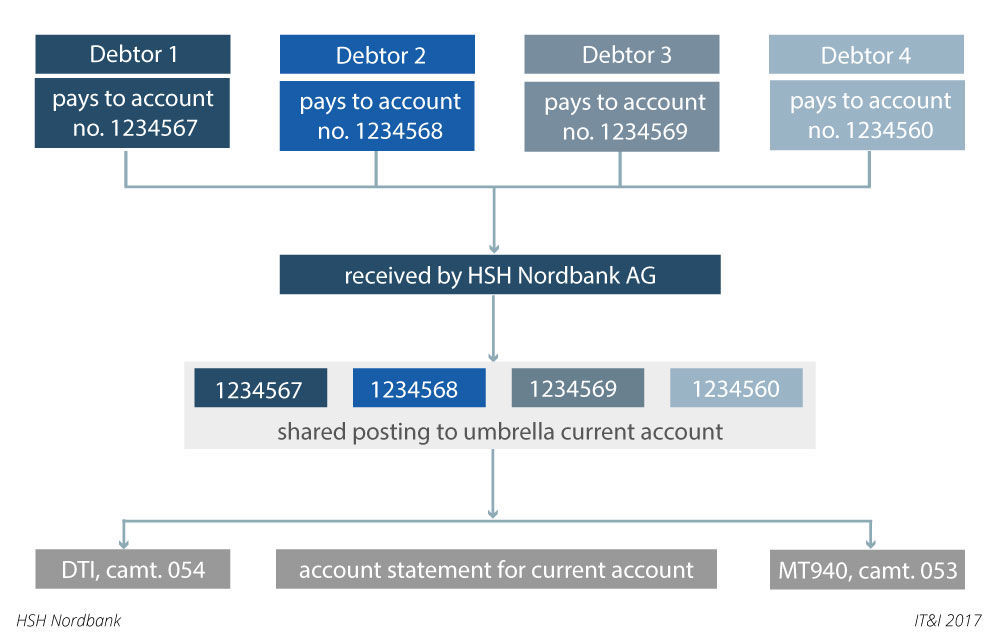

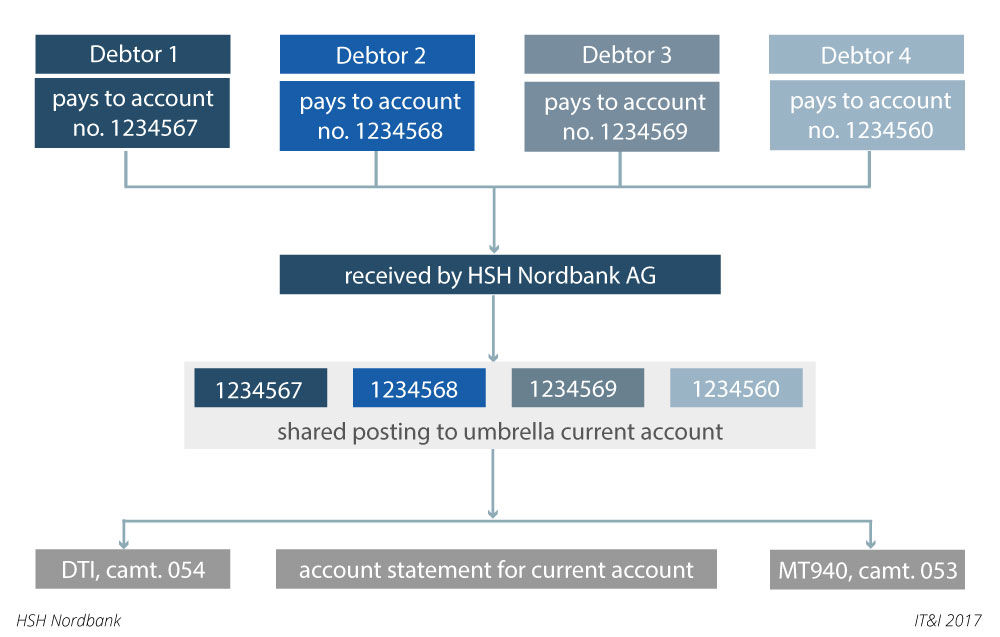

Figure 2: How virtual account numbers (1234567, 1234568, etc.) work for incoming payments. DTI = breakdown of batched transactions in electronic bank statement MT 940 camt.054 (cash management) = breakdown of batched transactions in electronic bank statement camt.053. MT940 (message type) = bank statement in SWIFT standard format. camt.053 = bank statement in SEPA XML format.

Figure 2: How virtual account numbers (1234567, 1234568, etc.) work for incoming payments. DTI = breakdown of batched transactions in electronic bank statement MT 940 camt.054 (cash management) = breakdown of batched transactions in electronic bank statement camt.053. MT940 (message type) = bank statement in SWIFT standard format. camt.053 = bank statement in SEPA XML format. |

What benefits do virtual accounts provide?

- By using virtual account numbers for tenants, the housing company benefits from clear contract assignment in SAP®.

- A ratio of almost 100 percent is achieved for direct allocations. The probability of incorrect postings was also significantly decreased thanks to introduction of IBANs instead of the bank sort code.

- Time and costs are saved as a result of a significant reduction in the manual posting workload and the number of incorrect postings. Incomplete payment reasons no longer have to be followed up. The payment reason of the bank transfer is no longer relevant for the landlord.

- Real sub-accounts are no longer required and can be closed.

It is also possible to reduce the number of paper bank statements by batching transactions.

Yoram Matalon, Transaction Banking area manager, HSH Nordbank AG

Author:

Stefanie Buhtz

is a head of department at HSH Nordbank AG and has a business degree from the University of Hamburg. In her time at HSH Nordbank and in various roles, she has accumulated many years of experience as a corporate customer advisor. She is currently Senior Vice President for the Cash Management Sales division and focuses on real estate and the logistics and infrastructure sectors.