Management of Loan Contracts

A clear view of liabilities and receivables

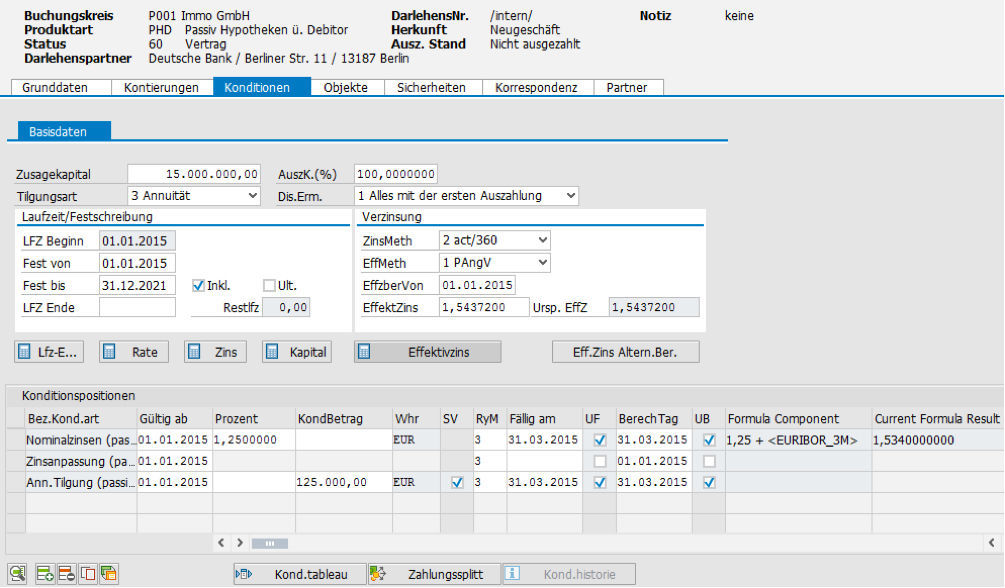

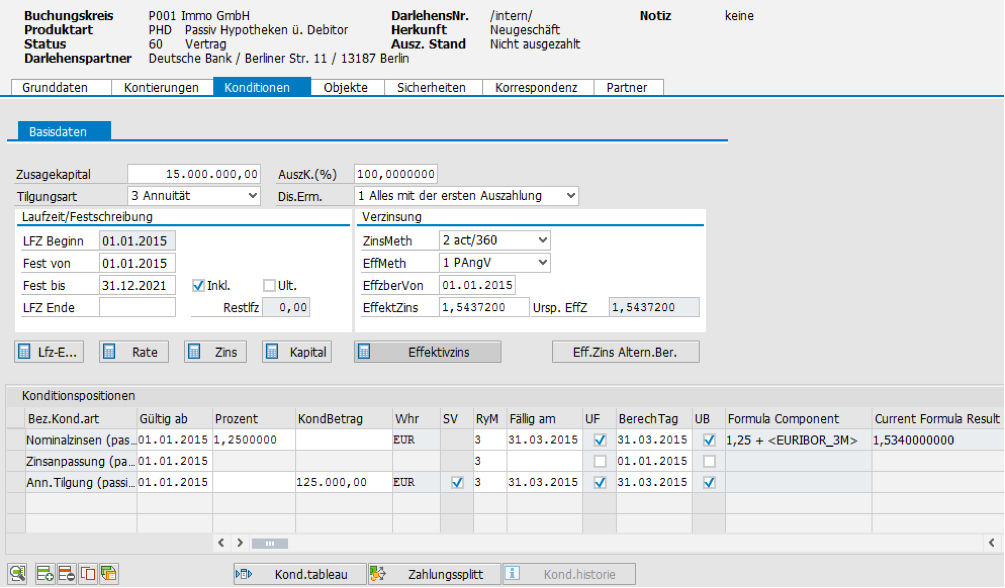

Mapping of loan contracts and the sometimes extremely complex contract conditions of the contracting banks in the ERP system frequently requires extremely detailed knowledge of the contract structures. In the SAP® ERP system, the contract information is stored once in an application in the Loan Management (FS-CML) module and can then be processed and posted periodically.

In addition to the purely passive view of the borrower, there is also the option to map active loan contracts, regardless of whether they are for a Group company or an external organisation or person.

The analyses that SAP provides and PROMOS enhances make it easier to map the loan contracts in the leading accounting system SAP® ERP and periodically manage all loan liabilities or receivables.

In its standard system, SAP® provides the option to map almost all contract information. Functions such as individual business transaction entry, individual and mass postings, periodic accrual and posting in various depreciation areas cover almost all business transactions in loan management.

PROMOS enhances the analyses and simulations that are available as standard in the loan module with further solutions, functions and reports for the most important activities:

- Breakdown of liabilities

- Capital market loans (mapping of all existing contracts with banks)

- Service and stock overview

- Interest simulation (for nominal interest and variable interest)

- Repricing balance sheet

- Loan for business entity

Furthermore, a PROMOS customer tab in the contract master data provides the option to store individual contract data. In addition to CO account assignments, which are automatically added to the posting document, additional information on follow-up financing, covenants and land register relationships is implemented here.

Your benefit

Transparency: PROMOS enables a standardised view of the relevant master and management data for the existing loan agreements. Time-consuming analysis across various reports is no longer required.

Analysis options: With the PROMOS solution, extensive forecasts and simulations can be performed conveniently based on planned and actual values.

References

End user

- Finance departments

Technical requirements

- PROMOS.GT

Please contact us:

PROMOS consult Projektmanagement,

Organisation und Service GmbH

Rungestraße 19

10179 Berlin-Mitte

Germany