PROMOS Reporting Loan Management

Make well-founded financing decisions in just three clicks

Keeping track of cash and cash equivalents and their development and current and future payments from loan commitments as well as evaluating upcoming financing decisions are an essential part of any management in companies that are – at least partially – financed by third parties. In practice, this often results in complex data collection and preparation that quickly stretches the limits of Excel or similar spreadsheet calculation programs.

PROMOS Reporting Loan Management provides three complementary applications for many of the requirements of financial management. These include not only reports on existing contracts, but also the option to consider and analyse potential future financing decisions.

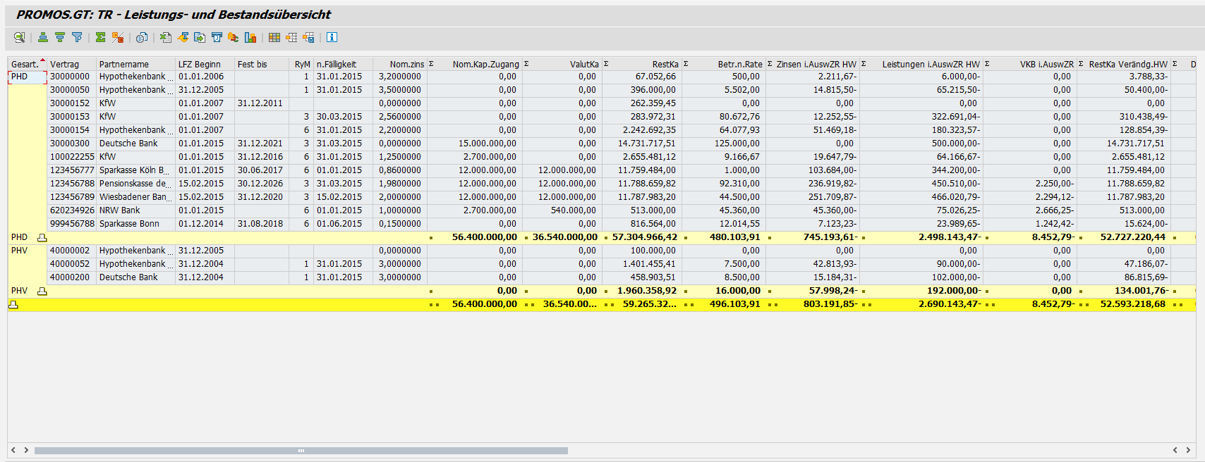

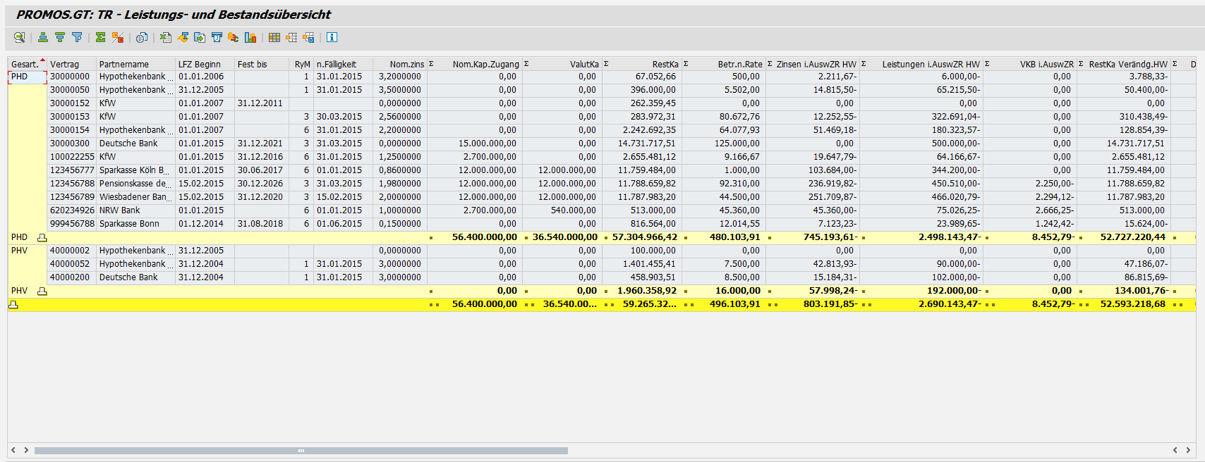

Service and stock overview

The service and stock overview is used to evaluate the loan stock and, in particular, the development of the stock as well as the expenses and income over a freely definable period. Each report is clustered and output in a standardised manner based on expense, income or stock types.

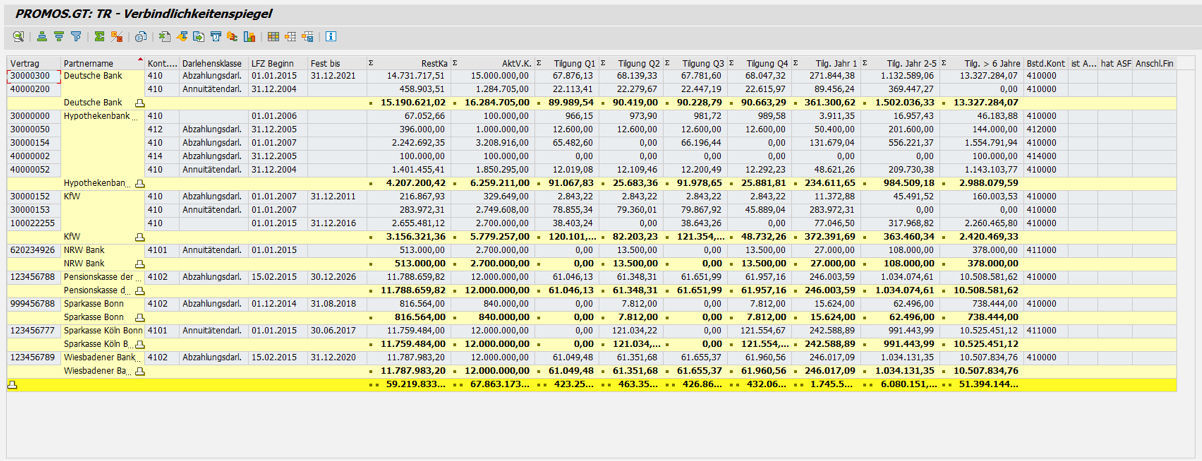

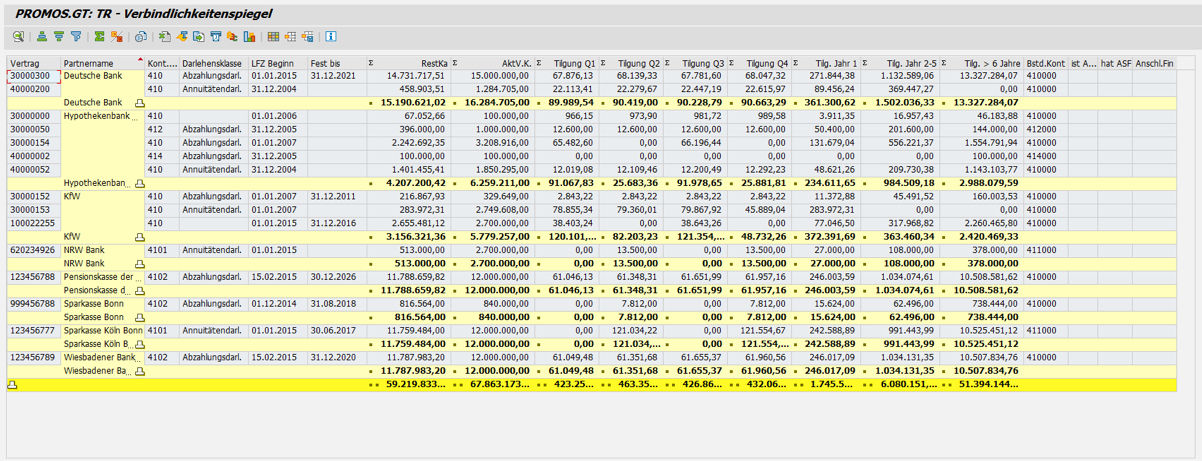

Breakdown of liabilities

With this closing-related report, you can classify the stock and payment development of loans in freely definable time slices or even by the quarter.

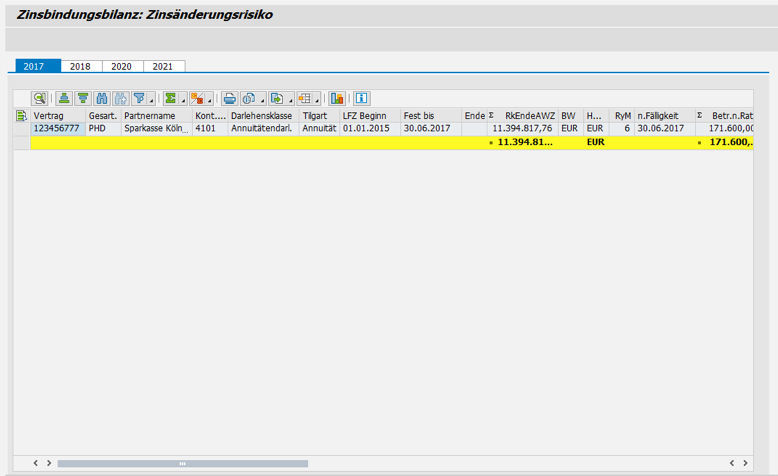

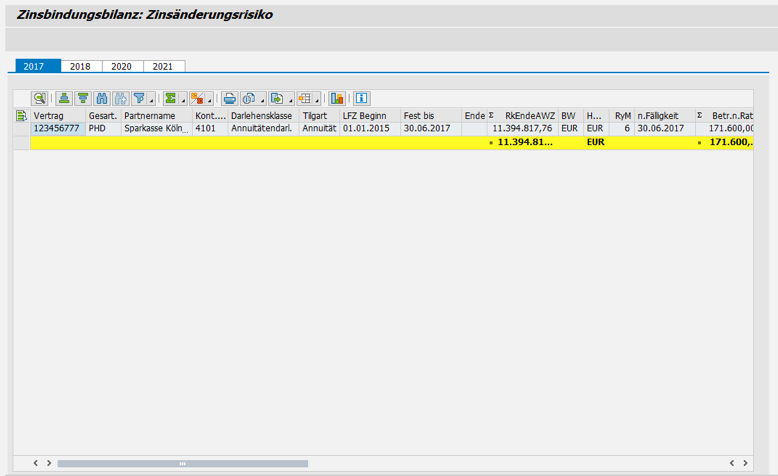

Repricing balance sheet

The PROMOS repricing balance sheet is used to determine future liquidity risks or interest rate risks from the current loan stock. Here, you can determine the need for action in time slices based on the contractually agreed deadlines.

All three reports include the option to force the exclusion of existing contract deadlines by means of selection so that you can check and evaluate scenarios.

Your benefit

Transparency: You receive all the information you require in a maximum of three reports.

Legal compliance: At the press of a button, you receive a breakdown of liabilities that meets all the legal requirements.

Support with decision-making: Required actions for financing can be anticipated in advance.

References

End user

- Finance departments

- Management

Technical requirements

- SAP® CML

Please contact us:

PROMOS consult Projektmanagement,

Organisation und Service GmbH

Rungestraße 19

10179 Berlin-Mitte

Germany