PROMOS collateral value calculation

Real estate valuation like the professionals - the thorough way to value your properties in SAP®

With tighter banking regulations under Basel III and the further-growing importance of financing, valuation of real estate is playing an even more important role in obtaining credit. No longer just an occasional special requirement, value appraisals have become almost an everyday event. The PROMOS solution for calculating the collateral value gives you an effective tool to calculate your financing volume and actively guide your decisions as part of credit management in SAP®.

The basis for calculation is the "collateral value" determined using the gross rental method. There is an option here to include property-specific mortgage risks in the calculation. The real estate master data is updated with the income, market and collateral values. It is also possible to calculate and compare the income value of properties with the residual book values of the assets.

Collateral value calculation enables determination of the mortgageable reserve for each accounting entity together with existing loans, full liability in the loan agreement, joint liability in the loan agreement and earmarked funds through analysis of all the relevant data for calculation using the interlinked master data for property, land and loans.

Basis for calculation

The basis for the calculation is the net income achievable on a sustainable basis. This equals annual rental income less all costs. Together with the capitalisation factor, it makes up the collateral value. The program calculates annual gross income (= total net income achievable per year) using the rental information stored in SAP® in the contracts for the properties. The management expenses that cannot be passed on to the tenant, e.g. operating, administrative, maintenance and vacancy costs and the risk of loss of rental income, are subtracted from this. Other parameters such as land value including the property yield or the residual useful life of buildings can be included in the calculation.

Functions

In addition to the parameter definitions and automatic calculation of the collateral value, the solution provides the following functions: A selection screen allows properties to be selected for information as of the valuation date. The property values are automatically calculated for the relevant valuation date and transferred to the ERP for the accounting entity. The result: your master data immediately shows you the key figures, as the collateral value, income value and their calculations are available in the database.

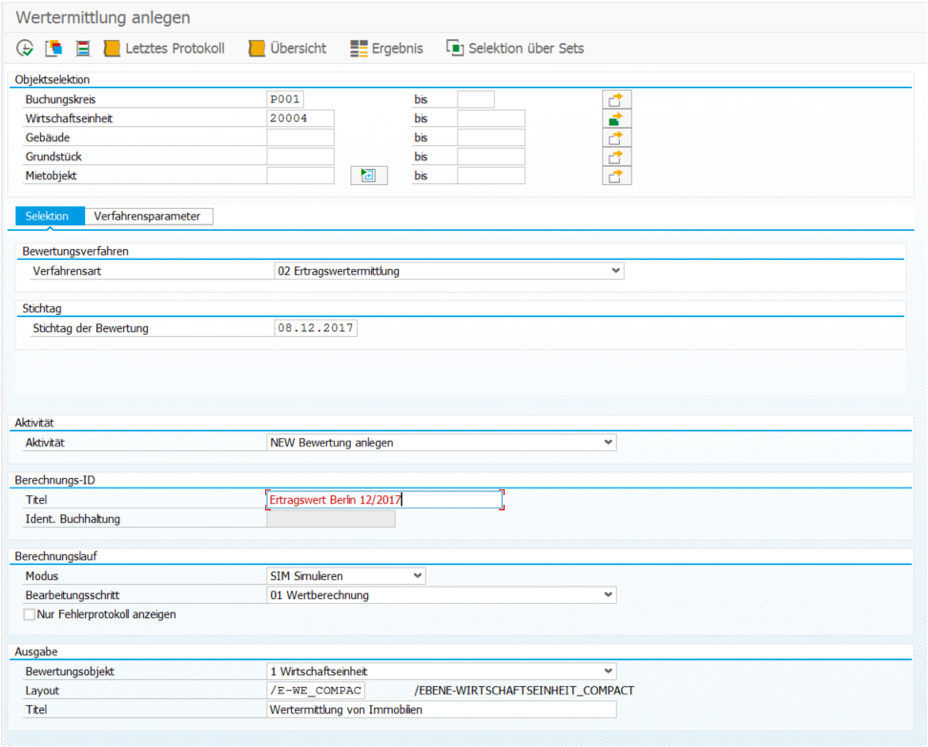

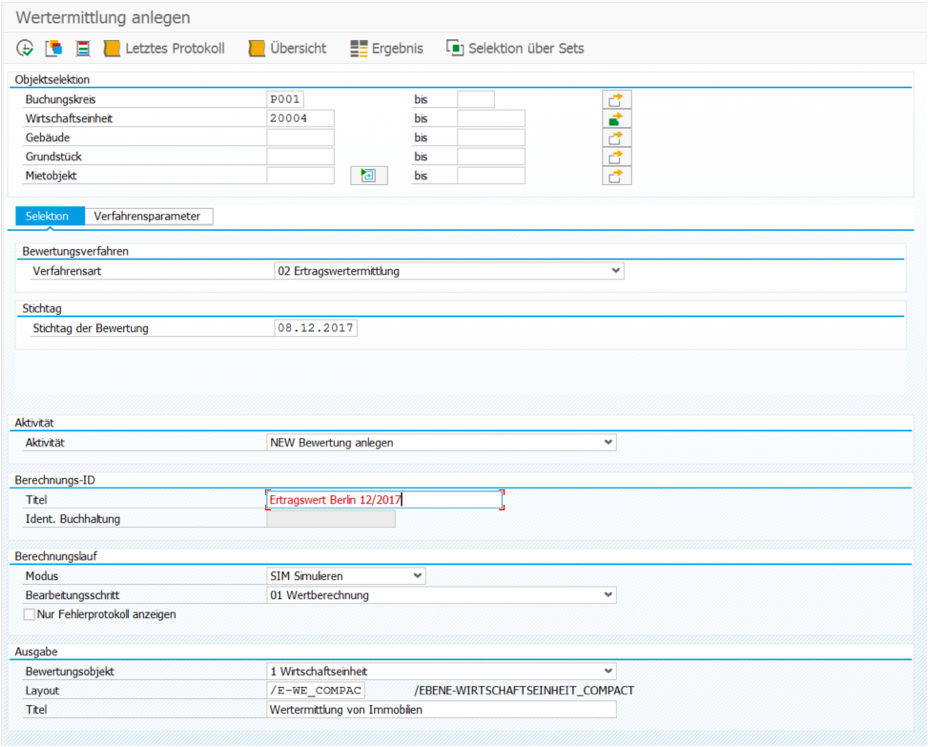

Selection screen to choose process type and properties to be valued

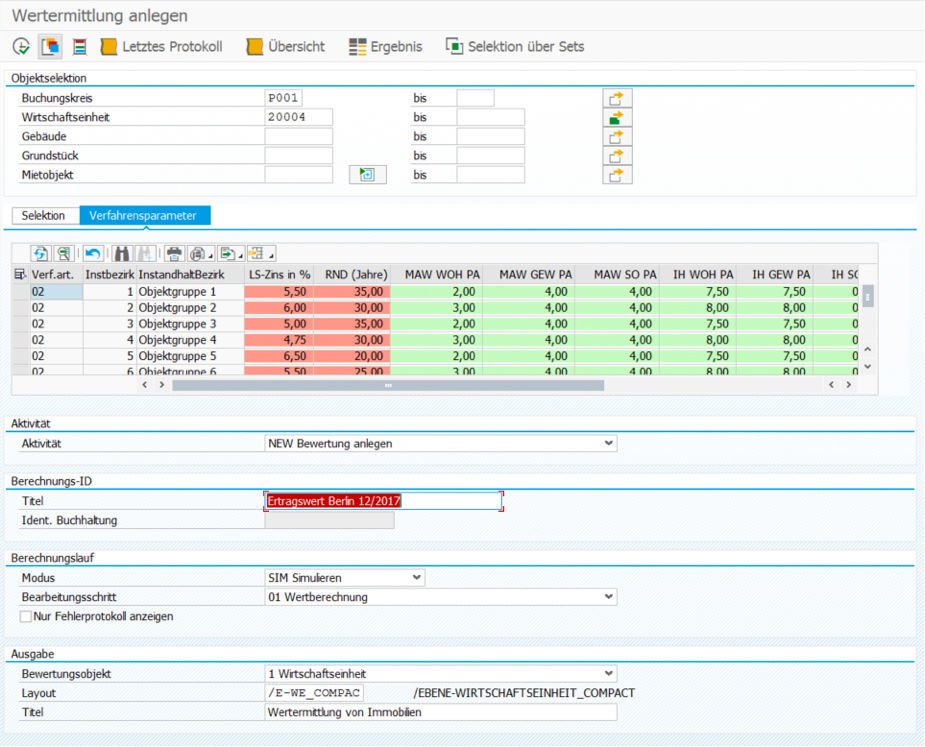

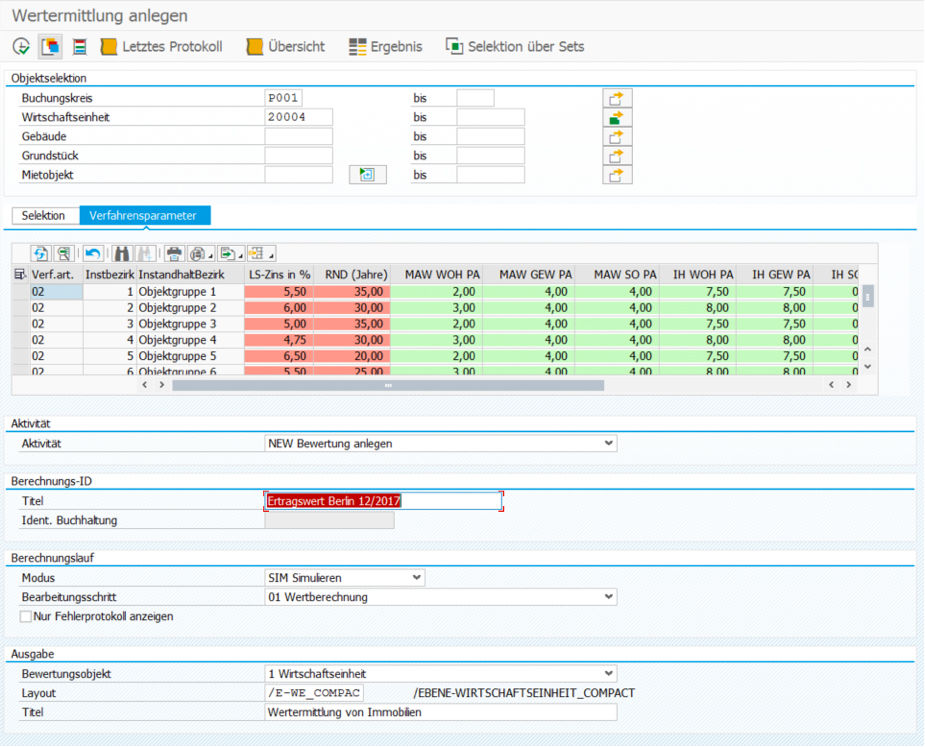

Defining parameters to control the calculation

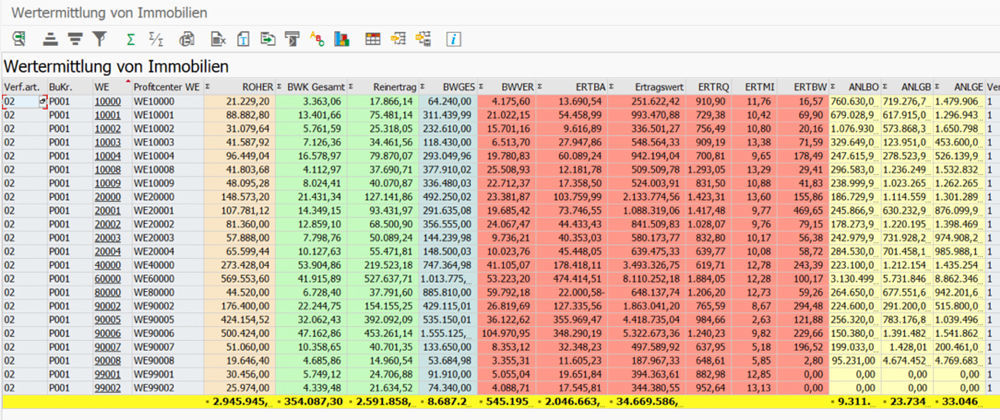

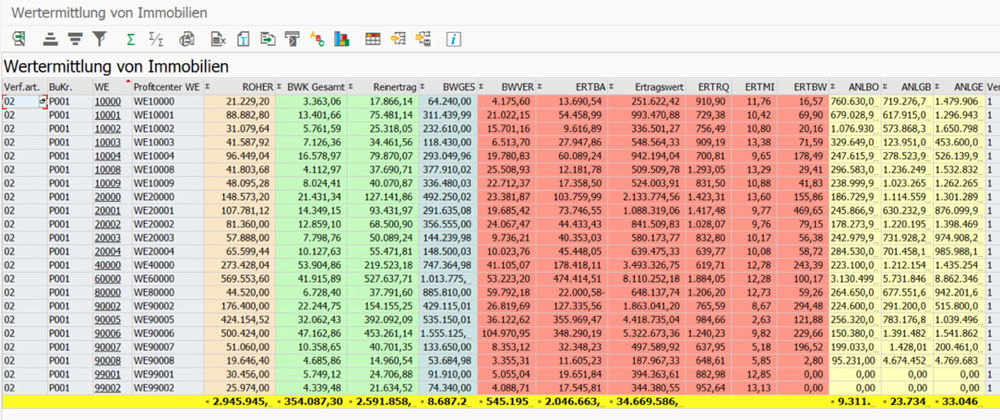

Valuation result in various levels of detail

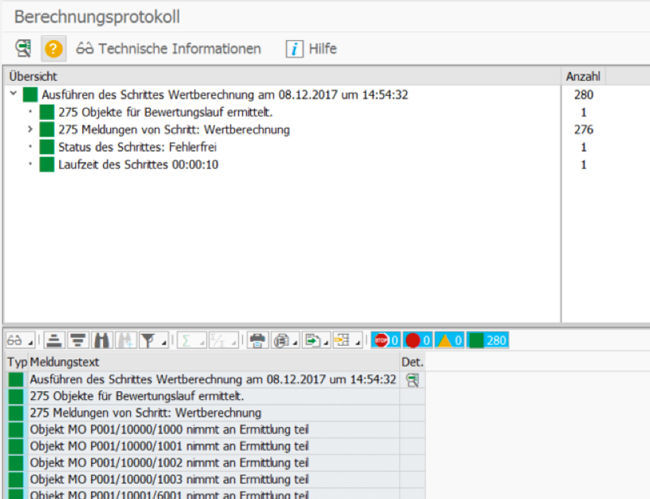

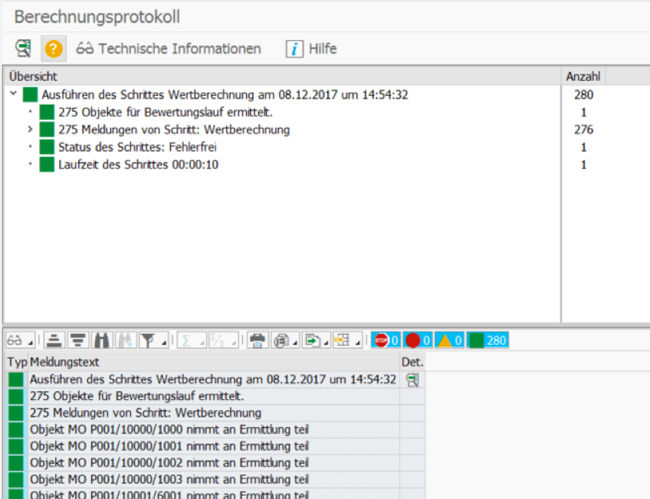

Calculation log

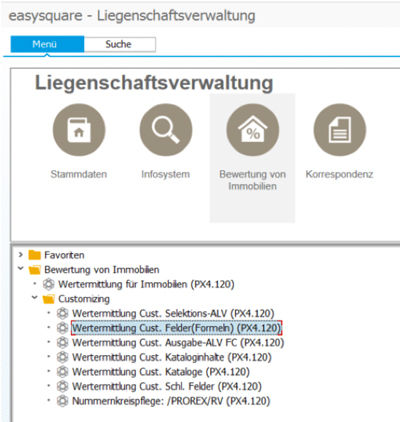

Start screen for customising to configure calculation rules

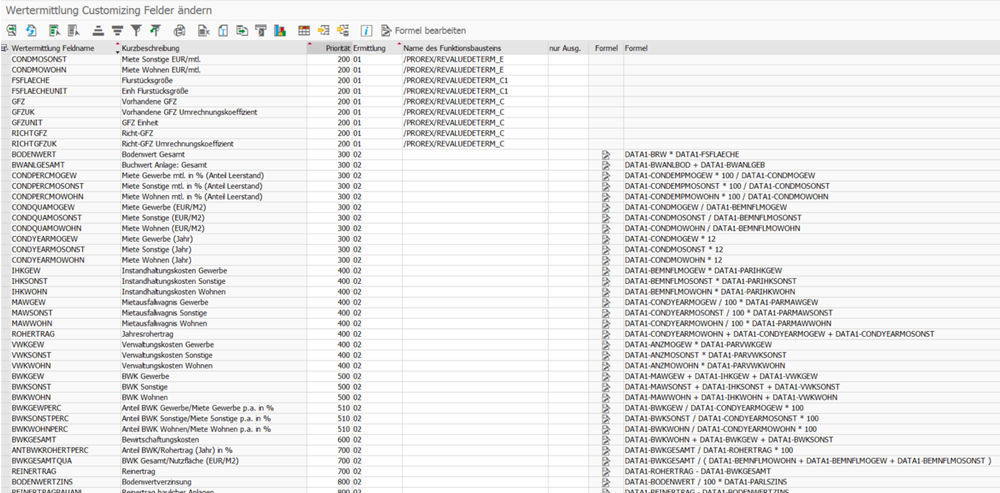

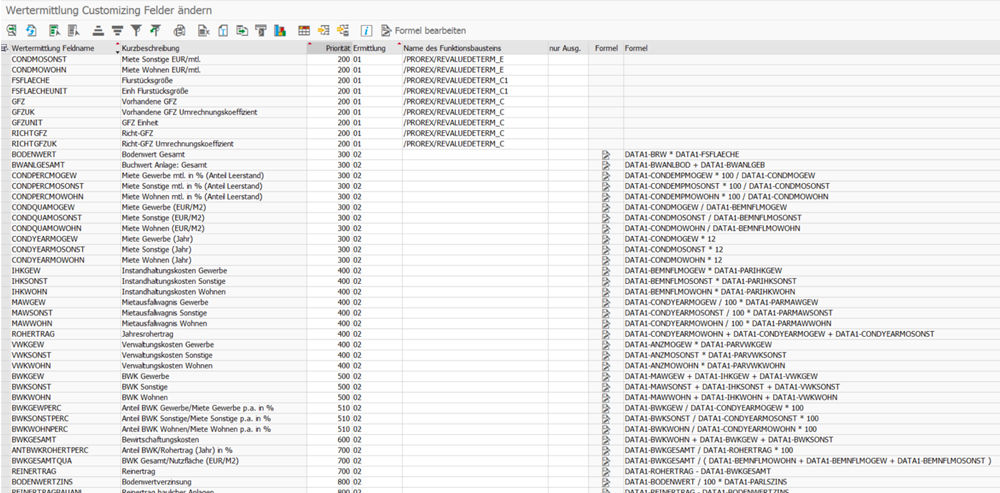

Example of customising in PROMOS collateral value calculation

Selection screen to choose process type and properties to be valued |

Defining parameters to control the calculation |

Valuation result in various levels of detail |

Calculation log |

Start screen for customising to configure calculation rules |

Example of customising in PROMOS collateral value calculation |

Further information

- Modes: Simulation and "real" reports can be generated and the process can run in the foreground or background.

- Calculation log: After the report has been completed, a log is generated showing any warnings or errors and confirming whether the calculation was successful.

- Results list: The ALV for value calculation enables, among other things, calculation of totals and subtotals as well as options for filtering and sorting the data. Data can be exported to Excel. Depending on the level of detail, users can jump straight from the ALV to accounting entities, buildings, plots and rental properties. The assets' residual book values are also determined to enable comparison with property income values.

- Customising: The program can be flexibly adapted to customers' needs. The basis for calculation is individually customisable. Multipliers and mark-ups or mark-downs can be included in the calculation using a form editor.

Your benefit

Transparency: The values calculated in "real" reports can be retrieved using a run ID so that the basis for calculation can be analysed transparently and in detail.

Flexibility: The system is designed to allow customised calculation methods. Even changes in economic growth can easily be incorporated.

Data availability: The income, market and mortgage lending values for an accounting entity can be saved in the master data so that the results can be used as a basis for your lending decisions.

Synergies: Comparison of the property income values with the asset book values enables you to make strategic decisions from a portfolio management perspective.

End user

- Loan managers

- Financing planners

- Land use managers

- Portfolio managers

Technical requirements

- SAP® Treasury and Risk Management (TRM)

- SAP® Land Use Management (LUM)

Please contact us:

PROMOS consult Projektmanagement,

Organisation und Service GmbH

Rungestraße 19

10179 Berlin-Mitte

Germany