Seeking X – collateral value calculation in SAP®

In almost all large housing companies, all of this information can be found in the ERP systems. So it makes perfect sense to use a solution that performs this calculation fully automatically without any additional interfaces to other systems. Two long-standing PROMOS customers are already using the collateral value calculation, and today we would like to present the solution to you in detail.

Status quo

Determining the collateral value is extremely important when determining your financial framework if you make use of external financing sources through banks. The collateral value determines the extent to which the property can be used as collateral in the form of a mortgaged object and thus serves as an upper limit for credit security at the financial institutions. For this reason, the valuation is performed based on content-based and methodological principles, which are anchored in the Beleihungswertermittlungsverordnung (German Ordinance on the determination of the mortgage lending value; BelWertV) or Immobilienwertermittlungsverordnung (German ordinance on the valuation of property/real estate; ImmoWertV), for example. General, the ordinances allow various procedures for determining the value of a property.

The PROMOS collateral value calculation specifically follows the principle of the German income approach, as this is what banks use – as previously described – to determine the collateral value of leased-out properties.

Calculation bases

The value of a property is not an exact number. Rather, it is based on rough estimates and assumptions regarding the current market value, the future income situation, etc. For this reason, the assessment during a property transaction, for example, may be very subjective depending on the perspective and interest situation. The seller will certainly assign a higher value to a property than the buyer. With the collateral value, all those involved are given a robust or stable key figure that is expected to be attained on the market in the long term regardless of economic value fluctuations even if the property has to be sold at short notice due to payment difficulties. If the collateral value is set too high, the potential credit risk increases. However, if too much caution was shown and the value set is too low, the housing company cannot tap the full lending revenue.

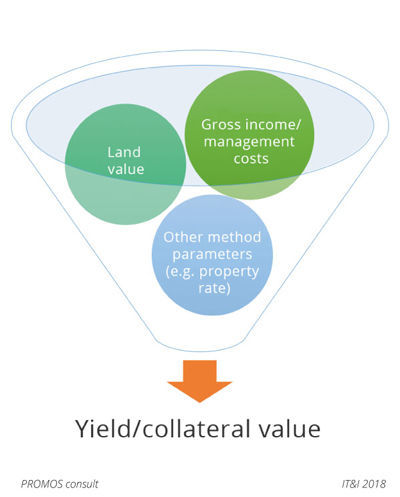

So which information and calculation bases are included in the scope of the PROMOS collateral value calculation? In actual fact, a great deal of data can be included in the calculation, which can all be found in your SAP® system (Figure 1). The calculation basis is the sustainably attainable net income, which is made up of the annual attainable yield from rental income based on the information on rents stored in the real-estate contracts minus all costs. This means you take the gross income from the real estate that results from the conditions (e.g. net rent excluding heating) and take away all components of the management costs that cannot be allocated to tenants, such as operating, administration, maintenance and vacancy costs as well as the rental loss risk. Depending on the usage type of the rental objects (residential, commercial, other) and taking measurement types into account, various cost approaches can be distinguished. Thanks to the variable evaluation method, additional customer-specific evaluation parameters can be defined and included in the calculation, such as the land value taking account of the property rate or the remaining useful life of buildings.

Figure 1: Property-related financing risks can be considered when valuing real estate.

Figure 1: Property-related financing risks can be considered when valuing real estate. |

ERP integration

For the valuation of undeveloped plots of land, information needs to be included from the properties that is only stored in the SAP® RE-FX land use module (LUM), such as plot sizes. This requires that housing companies use specific modules and components in SAP® but, at the same time, they benefit from the fact that the PROMOS collateral value consideration takes into account property-specific financing risks such as the land value and similar factors. The high level of system integration between the property, loan and asset accounting areas thus provide you with an ideal data quality as a basis for further calculations. This is the only way for the valuation to allow the real-estate income values to be compared with the residual book values of the assets.

Functional scope

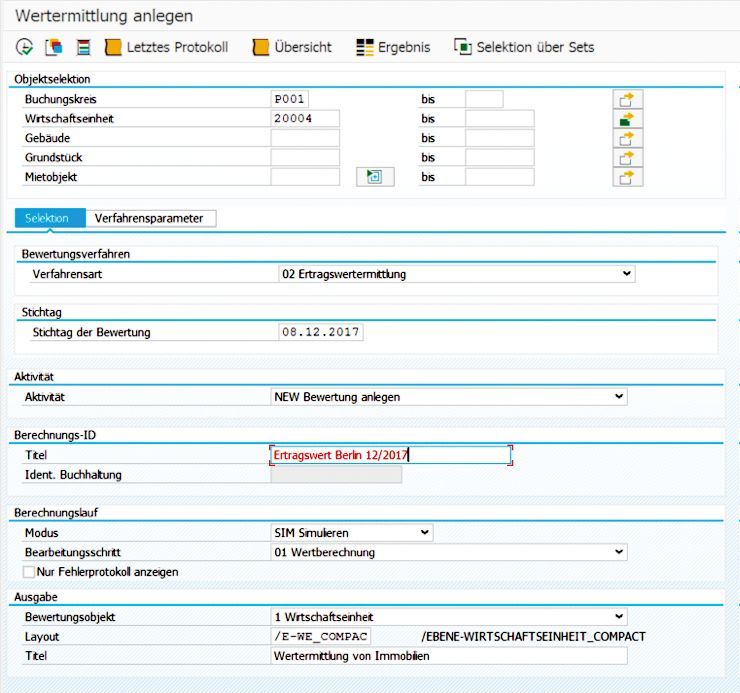

The PROMOS report for collateral value calculation provides far more functions than the name suggests. After calling the transaction /PROREX/RE_VALUATION, the user can select the properties for the valuation date, for example individual company codes, buildings or entire accounting entities (Figure 2). The application can be executed either as a simulation or “real run”. This allows the calculation to be reversed.

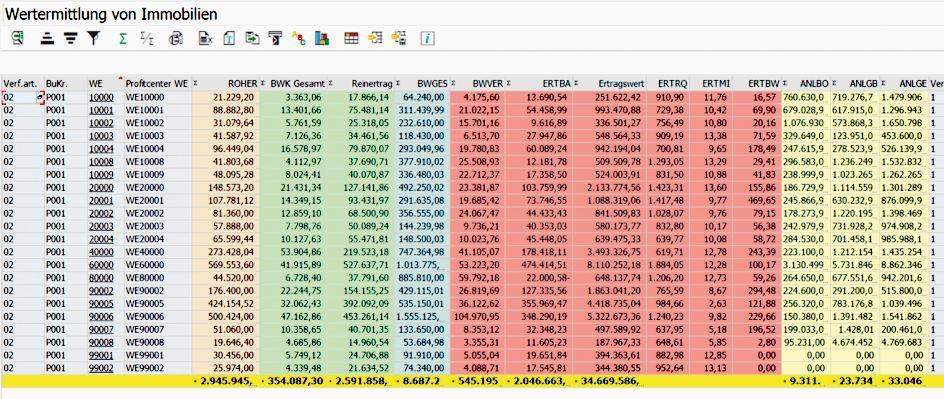

The user then receives a compact ALV overview, where totals and intermediate totals can be formed, and data filtered and sorted (Figure 3). The data can also be exported to Excel with ease. Depending on the summarisation level, the user can jump from the ALV directly to the accounting entity, the building or plot of land or the rental object.

Figure 2: On the entry screen, users can select the properties to be valued and define the valuation date, output mode and method parameters for the valuation.

Figure 3: The results list (ALV) for the valuation allows the formation of totals and sub-totals as well as filtering and sorting, among other things.

Regardless of the summarisation level, the data regarding the completed valuations is always updated as a calculation at the accounting entity level. The collateral, open market and/or yield values as well as the calculation sizes are thus transparently available in the database. So if a colleague from the loans department calls and needs the yield value for accounting entity 4711 at short notice, the employee can simply look in the master data and find the answer at a glance. The calculation is also logged accordingly in SAP® by means of a run ID, ensuring that the calculation parameters remain transparent for outsiders even after six months have passed.

And loan departments are not the only ones who benefit from the key figures. The information is certainly of interest for the area of portfolio management since the real-estate master data – enriched with the data from loan and asset accounting – is served up on a silver plate. Using this in combination with other information, portfolio managers can draw conclusions on the development of the real-estate portfolio; for example, is our inventory developing? What income are we earning? Is the real estate outdated? Does anything need to be renovated? Is it worth investing capital there? While the answers to such questions are not the core focus of the collateral value calculation, they are a useful source of information to be able to plan investment decisions better.

A practical business solution from professionals

The solution was developed and launched in 2011. Following a reference visit in July 2014, GBG Mannheim was also convinced of the solution. To improve integration of the master data and optimise the valuation options, the applications that had previously been used for mortgaging management were also replaced with the LUM component. The go-live was in 2016.

Summary

No matter from which perspective you view the real-estate valuation, with the PROMOS collateral value calculation you receive a sophisticated program with which you can extract, combine and prepare on a customer-specific basis a wide range of data from SAP® in order to find out the collateral value of your real estate. However, you do not need to exit the SAP® environment and perform the calculations manually in Excel at any point. Today, the valuation is performed fully automatically and yet guided by the user in your SAP® system.

Author:

Manfred Stegemann

Professional Consultant Real Estate

PROMOS consult