Fit for the growing e-payment market with platform solutions

© Aareal Bank AG

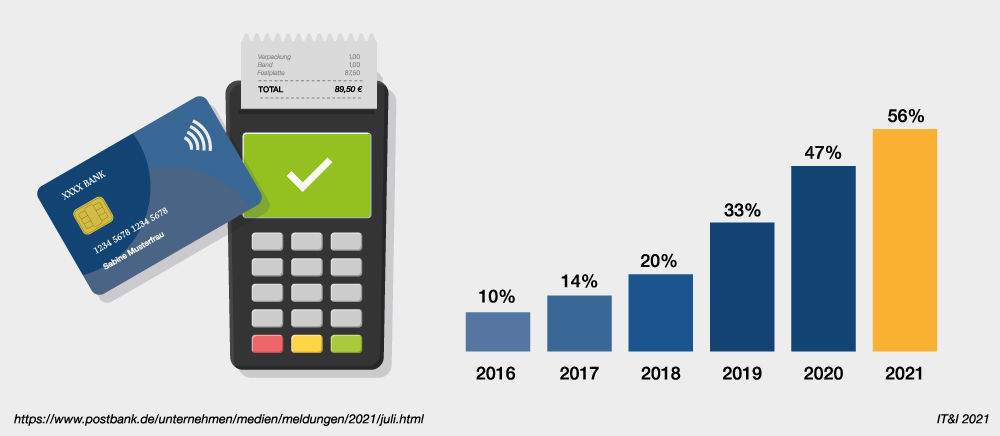

Whether via card or smartphone, more and more people are opting for contactless payment, and the pandemic has accelerated this development in 2021. The “Mobile Payment”[1] study from Postbank shows that 56 percent of Germans already pay with contactless methods using their bank cards, their smartphones (mobile payments) or both. Before the pandemic, it was only around a third of Germans, and five years ago it was only ten percent.

Also driven by the rapid rise of online retail, Internet payment methods are gaining popularity. From PayPal and Sofortüberweisung to giropay and Apple Pay, a whole range of providers have sprouted up over the past few years. PayPal, the undisputed head of the field, has once again significantly increased its number of German users in the past year and now, with almost 30 million users, has more customers than Deutsche Bank.

Change also reaches the rental market

These developments also have consequences for the housing industry. Although the majority of tenants still make recurring payments via direct debit, standing order or individual transfer, a survey conducted by Aareal Bank in 2019 showed that alternative payment methods are winning ground here as well. The trajectory of payment methods can already be seen today with suppliers and service providers. For contracts that are regularly newly concluded, the classic direct debit is becoming less important. The current development shows consumers prefer to pay their monthly electricity bill with PayPal instead of issuing a new direct debit authorisation after twelve months when they’ve switched to a cheaper provider.

Figure 1: More and more Germans use contactless payment. More than half of them are already paying in a contactless manner with cards, smartphones or both – and the trend is growing.

One solution for all cases

Housing companies are smart to offer their tenants a wider range of easy-to-use payment options that better suit their day-to-day lives. In many cases, however, the complex connection to ERP systems has prevented the housing industry from integrating new payment services. After all, they previously had to enter into negotiations with each provider individually and connect to their interfaces.

The Aareal Bank Group has developed a convenient solution for this purpose. The Aareal Exchange & Payment Platform (AEPP) connects the ERP systems of housing companies with the respective systems of external payment providers, such as PayPal, in order to easily map the processing of all transaction-related processes via a central platform and seamlessly connect them to their own systems. Payment requests are generated and sent automatically. Tenants can then pay via their preferred payment service – and incoming payments are posted to the housing company’s ERP system without additional effort. Along with the processed payment, all required data such as information relevant in receivables management is made available and posted in the ERP system at the same time. The complex checking and processing of alternative payment methods is thus completely automated via the platform and integrated into the ERP system.

The housing company is therefore able to react flexibly to tenant behaviour, and tenants are free to choose their preferred payment method. Viacash/Barzahlen.de, PayPal and various credit cards, including Visa and MasterCard, are currently integrated in the AEPP. With Viacash, an interface for cash and card payment through supermarkets is integrated, as many tenants still pay their rent in cash. With the platform solution from Aareal Bank Group, housing companies can thus also transfer the previously tedious operation of a cash till into an efficient, digital process.

Figure 2: Platform solutions such as the Aareal Exchange & Payment Platform (AEPP) enable the housing companies to easily integrate and operate digital payment for their customers.

Figure 2: Platform solutions such as the Aareal Exchange & Payment Platform (AEPP) enable the housing companies to easily integrate and operate digital payment for their customers. |

Improved customer service

The integrated platform solution also provides housing companies with an effective tool to improve and further expand their customer service. For example, if tenants are late on rent, it is now possible to send an e-mail from the ERP system in parallel to the telephone collection call and send it in the background via the platform so that tenants can still pay easily and conveniently during the conversation. This combines existing processes with new digital solutions and increases the willingness to pay while also speeding up payment.

In addition, many housing companies are now looking for ways to open up new business areas. Residential services such as a caretaker service, laundry or ironing services, shopping, cleaning or food offerings can both boost customer loyalty and also offer the possibility of establishing new sources of income. To avoid the laborious individual integration of many different services or other service providers, companies can look to platform solutions just like the AEPP – for example in the payment process.

Integration into the easysquare tenant app

The basis for all these opportunities is the simple integration capability, which is an essential part of the Aareal Exchange & Payment Platform. It can also be integrated into other systems and is therefore now part of the easysquare tenant app from PROMOS consult. In addition to documenting contract documents, claims and utility statements, the app allows tenants to pay rent with just a few clicks via their preferred payment provider – and housing companies can process their payment transactions efficiently and entirely automatically. On the one hand, this fulfils the customer’s desire to do as much as possible on a single app. On the other hand, housing companies have the opportunity to optimise their payment management and ideally align themselves for the future.

A trend with staying power

The trend towards mobile payment will continue and even intensify. Companies everywhere, not just in the housing industry, are well advised to adapt their processes to user preferences. Platform solutions offer great potential for optimisation, not only in terms of technological solutions. By integrating systems and new partner services, housing companies can also expand their service offering and reinforce their innovative strength and future viability – thus adapting their processes to the needs of tomorrow’s tenants today.

- 2021 Postbank digital study on mobile payment (in German) at https://www.postbank.de/unternehmen/medien/meldungen/2021/juli/studie-mehr-als-jeder-zweite-deutsche-nutzt-kontaktlose-bezahlmethoden.html

Author:

Kai Wirthwein

Aareal Bank

works in Business & Solution Development at Aareal Bank. As an expert on future issues relating to payment transactions in the housing industry, he is committed to exploring the potential of platform solutions for housing companies.

More information about the cooperation: